The increasingly frequent materialization of physical and transition climate-related risks has led companies around the world to include climate-related risks in their risk management systems. Climate-related risks can intensify the effect of the so-called traditional risk categories and thus cause disruptions in the companies’ operations, local and global supply chains, as well as disruptions in financial markets. Also, the impact of climate-related risks on overall financial stability is increasingly being considered.

According to data from the World Meteorological Organization, the number of weather disasters increased five times from 1970 to 2010, while economic losses caused by weather disasters reached 1.38 trillion dollars from 2010 to 2019. On the other hand, companies develop sustainable business strategies that include analysis of exposure to climate-related risks, disclosure of exposure to these risks, use of scenario analysis to assess the impact of different climate scenarios on business, and development of management strategies for identified material climate-related risks.

Analysis by the rating agency S&P shows that over 90 per cent of the world’s largest companies will have at least one part of their assets significantly exposed to physical climate risks by 2050, while in the case of limiting the growth of the average global temperature in accordance with the Paris Agreement, the number of companies that are exposed to physical climate risks would be significantly lower and amount to 39 per cent.

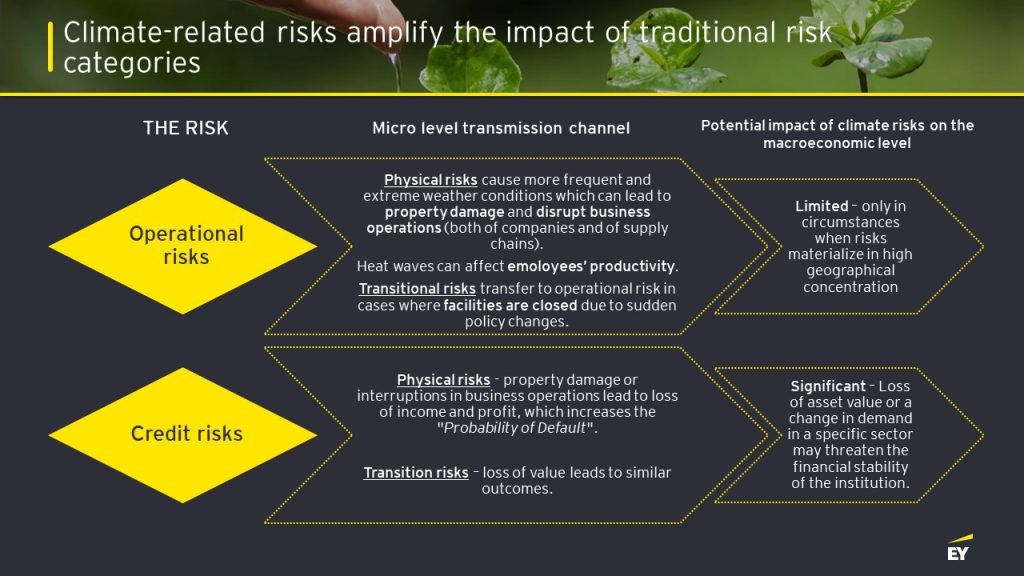

Climate-related risks spill over into traditional risk categories. They can act as a multiplier of these risks, which can have significant financial consequences both at the level of individual companies and at the level of entire economies.

Climate-related risks and operational risk

Operational risks, as risks inherent to the companies’ business, are affected by climate-related risks primarily at the micro level, i.e. at the level of individual companies. Increasingly frequent and extreme weather events can damage and/or destroy company property, causing material damage due to loss of property but also potentially significantly greater damage through business interruptions. Business interruptions cause losses not only to companies exposed to physical risks but also to companies in their supply chain, that will consequently experience certain business interruptions or stoppages. An additional channel of the impact of physical climate risks on companies’ operational business is the reduction of worker productivity. Increasing temperatures in the summer months reduce the productivity of workers in construction, agriculture, and other industries whose operations require workers to stay outdoors. Transitional climate risks will act as a multiplier of operational risks, most often in the event of sudden changes in regulatory requirements that will result in the need to close parts of the plant or the entire plant. For example, a directive requiring the reduction of harmful gas emissions into the air can lead to the shutdown of entire plants if it is judged that their adaptation to new regulatory requirements is unprofitable for the company.

Also, the transmission of climate risks into operational risks usually ends at the micro level. Impacts on the macroeconomic environment will only exist if there is a large geographical concentration of companies from the same sector. For example, the floods in Thailand in 2011 significantly threatened the global supply of semiconductors because a large number of semiconductor components are produced in Thailand.

Climate-related risks and credit risk

Climate-related risks can be a significant credit risk multiplier for companies. Property damage and/or business interruption due to the materialization of physical climate risks may result in a loss of revenue and profit for the company and jeopardize its ability to service debts. In such situations, the company’s probability of default increases. Similarly, regulatory changes or changes in consumer expectations as a form of transition risks can lead to a premature write-off of the company’s assets and, thus, lower collateral value or impact the company’s ability to service its obligations. The transmission of climate risks into credit risk can have significant implications at the macroeconomic level and is one of the main reasons for the increasing involvement of financial sector regulators in the management of climate-related risks by financial institutions. Banks should assess the degree of exposure of their portfolios to the impact of both physical and transition risks.

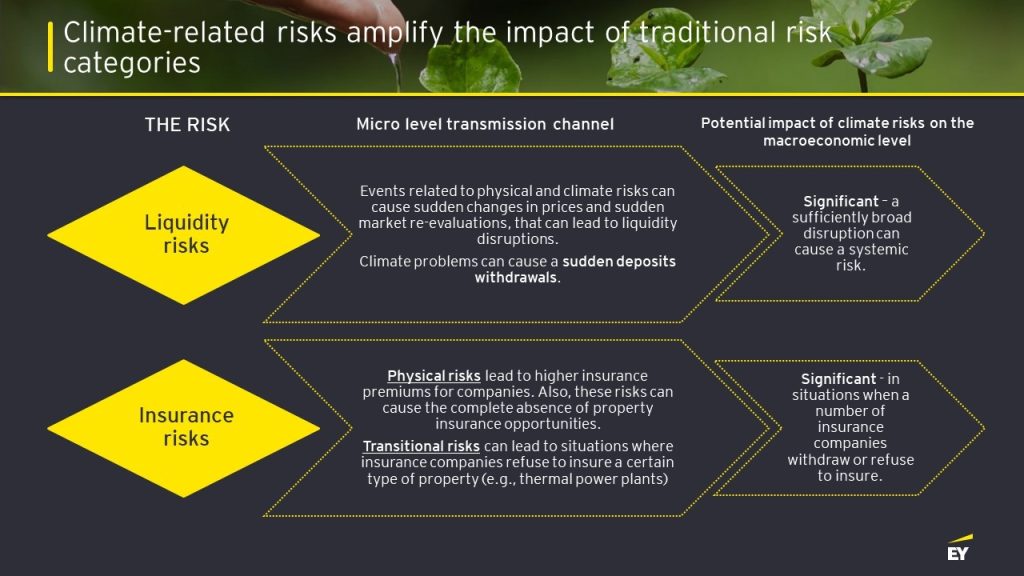

Climate-related risks and liquidity risk

Droughts, floods, extremely high temperatures and other forms of physical climate risks, as well as technological progress, changes in regulations, changes in client expectations and other forms of transitional climate risks, can significantly affect the liquidity position of companies. The materialization of climate risks can lead to significant and sudden changes in the value of listed companies. The materialization of climate risks can significantly pressure the banking sector. At the same time, there can be a substantial withdrawal of deposits and a high demand for liquid assets (cash) on the one hand and a greater demand for loans from companies on the other hand. This situation can result in a liquidity shock that can have wider macroeconomic implications if it covers entire sectors or regions. However, climate-related risks are more likely to affect individual companies through the channel of credit risk than liquidity risk.

Climate-related risks and insurance risk

When it comes to insurance risks, greater exposure to physical and transition risks can lead to a significant increase in insurance premiums for certain sectors or a decrease in the willingness of insurance companies to provide insurance coverage to high-risk sectors. High insurance premiums can significantly increase costs and thus reduce the profitability of companies, while limited access to insurance can seriously threaten the company’s operations. If the company is not insured, it must pay for any damage to property or the costs and fines of its court cases, which may threaten its liquidity, profitability, and ability to continue operating.

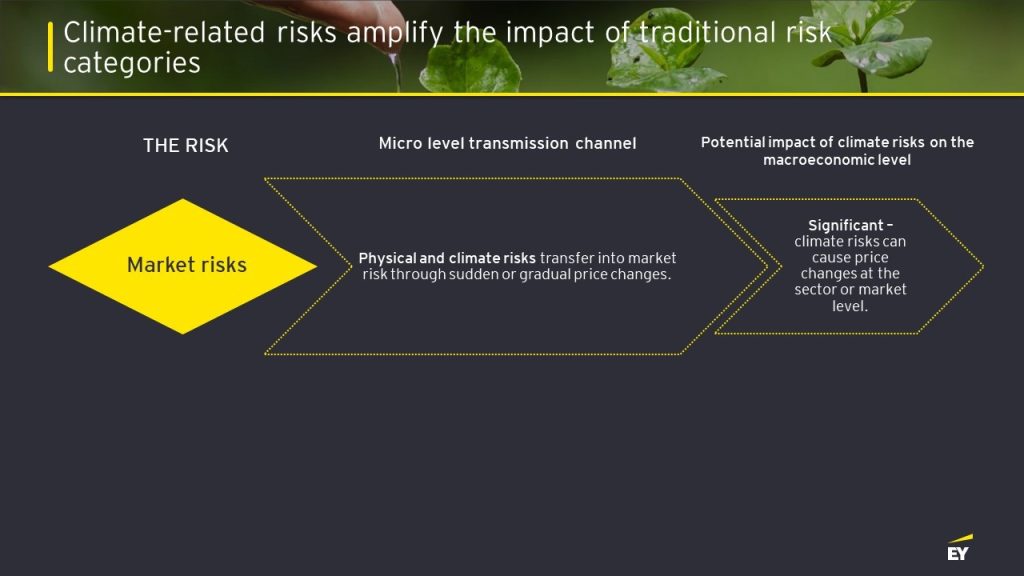

Climate-related risks and market risk

Transition and physical climate risks can become a significant component of the price of shares and bonds of companies listed on the stock exchange, which would lead to the so-called pricing of climate-related risks, i.e. a gradual adjustment of the prices of financial instruments for climate risks to which the company is exposed. This would mean that in addition to, for example, the country risk premium, which is an integral part of the price of financial instruments of companies from developing economies compared to companies from developed countries, a certain premium is also incorporated into the price of financial instruments that reflects the greater exposure of companies from certain markets and/or from certain sectors to climate risks. Adjusting the prices of financial instruments for the effects of climate-related risks can cause significant changes in portfolio values, especially for companies whose portfolios are dominated by carbon-intensive “brown” companies.

The tendency of investors to value climate-related risks is visible through the rates of return on green and other types of sustainable bonds. Investors are ready to accept a lower yield for a green bond than for a conventional bond, so we have the emergence of the so-called greenium. Greenium occurs when a bond on the primary market has a higher price and a lower rate of return compared to the existing debt of the same issuer on the secondary market, indicating that investors are willing to accept a lower return for green bonds that contribute to the achievement of sustainability goals and have low exposure to climate-related risks. On the other hand, it is cheaper for issuers to raise funds by issuing green compared to conventional bonds.

Climate-related risks and country risk

Climate-related risks may also lead to a significant increase in the risk of the entire country in a situation where the country is quite exposed to the materialization of risks, such as floods, which, in addition to the destruction of the physical property and significant public expenditures, can result in lower GDP growth and more expensive state debt on the international market. Also, countries whose energy mix largely depends on fossil fuels certainly have high exposure to transition risks (primarily regulatory and technological risks), which can additionally increase the cost of their borrowing on the international market due to a potentially limited ability to service debt in the coming period.

The materialization of climate risks will first affect companies from the real sector, and their ability to service debt will also affect the financial sector. Realizing that climate risks can significantly impact entire sectors, regions, and even the broader macroeconomic environment in the coming years and that they no longer represent a negligible risk category, regulators at the global level are paying more and more attention to climate and environmental risks. Adequate identification, evaluation, and mechanisms of climate risk management as well as transparent reporting on these processes, will represent the basis of the competitive advantage of companies in the years to come. On the other hand, transparent reporting of the real sector on climate and environmental risks will provide banks with a large enough database to incorporate this risk category into risk management and business decision-making.

Source: ESG team EY Serbia