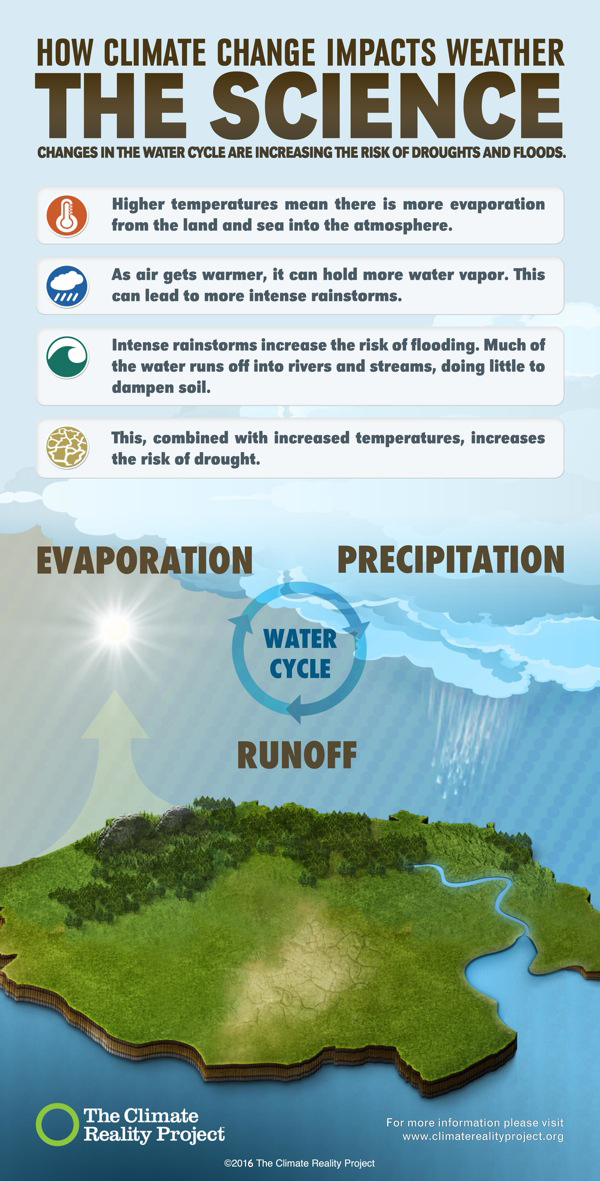

Last autumn, as part of MIT’s Plan for Action on Climate Change, the Institute announced plans to create Low-Carbon Energy Centers to advance key technologies that will address climate change. Since then, MIT Energy Initiatve (MITEI) team members have been speaking with interested industry leaders in the United States and around the globe to lay the foundation for collaboration through the centers.

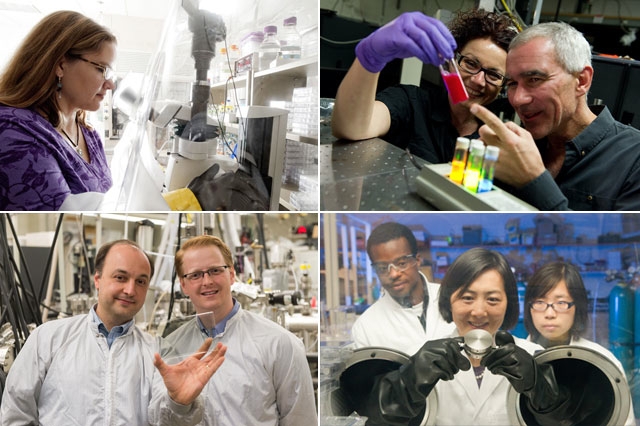

“When we’re looking at challenges as complex and vast as addressing climate change while meeting global energy needs, we need to engage experts across all disciplines and sectors,” says MITEI Associate Director Louis Carranza, who is spearheading the development of the centers. “Through the Low-Carbon Energy Centers, MITEI is facilitating this vital collaboration. We’re enabling faculty members from across MIT to converge around specific technology research areas and providing a program for industry and governments to join us in advancing these technologies and scaling them from the lab into the marketplace.”

The inclusive model of the Low-Carbon Energy Centers prompted Exelon to become a MITEI member. As Exelon President Chris Crane said in the February 2016 announcement made at IHS CERAWeek, “We know the energy system of the future will need new technologies such as energy storage, smarter grids, advanced nuclear generation, solar energy, and more. Together with the MIT Energy Initiative, we will actively identify and develop the most promising innovations in our sector, as the centers bring together a perfect trifecta of academia, government agencies, and private organizations to tackle long-term challenges in reducing our carbon footprint and evolving our energy system.”

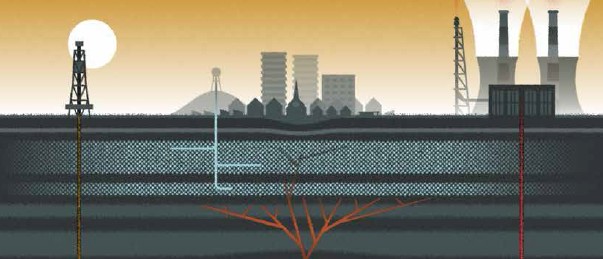

Each center aims to advance research on solutions in a specific technology area: solar energy; energy storage; materials for energy and extreme environments; carbon capture, utilization, and storage; advanced nuclear energy systems; nuclear fusion; energy bioscience; and electric power systems. Centers are led by MIT faculty directors, with broad involvement from researchers across schools and departments, and a Faculty Steering Committee and Advisory Committee that provide guidance. Members can join one or more centers, based on their research needs and interests, and participate by providing financial support as well as offering technical and market expertise.

In engagements with industry and government, the MITEI has learned that one of the greatest inhibitors of moving research forward is uncertainty. This is as true for faculty, research staff, and students as it is for our industrial partners. To address and mitigate this uncertainty, each center will have a dedicated research team focused on monitoring, tracking, and reporting on the evolving performance and economic potential of emerging technologies. This resource will help provide guidance and definition for the opportunity space that each center will be exploring.

Source: news.mit.edu